India, boasting the world’s second-largest internet user base, has rapidly adopted fintech innovations, making it one of the most rapidly expanding fintech markets globally. The Indian fintech landscape is diverse, spanning crucial areas such as digital lending, digital payments, insurance tech, wealth tech, and blockchain, among others.

In this vibrant ecosystem, PB Fintech has established a distinct presence. This global titan has transformed the financial sector with its pioneering online platforms – ‘Policybazaar’ and ‘Paisabazaar’.

PB Fintech’s recent Q4 results triggered a wave of activity in the market. The robust performance resulted in a notable surge in the stock price, indicating the market’s positive response to the results.

This article explores PB Fintech’s recent quarterly results and how the market reacted to its release.

About the company

Paisabazaar has carved a niche for itself as the go-to platform in India for diverse credit requirements, fielding around 20 lakh credit inquiries each month from more than 1,000 urban and rural locations. PB Fintech, a global fintech powerhouse, provides insurance offerings via its online portal ‘Policybazaar’ and financial products through ‘Paisabazaar’.

The company functions as an all-encompassing entity that houses some of India’s leading marketplaces, offering streamlined solutions for insurance and credit to its customers. These platforms simplify complex choices, provide customised suggestions, and enable customers to make well-informed financial decisions.

Leveraging data and technology, the company encourages innovation in its products and processes, benefiting both its partners and internal operations. Its business model thrives on the network effects resulting from consumer demand, deep risk insights, and superior service quality.

Also read: From colonial legacy to global ambition: The Indian insurance sector

PB Fintech Q4 results highlights

Here are some of the key financial metrics of the recent quarter results as compared to the same quarter previous year:

| Q4 FY24 | Q4 FY23 | |

| Net revenue (₹ crores) | 1,090 | 869 |

| Operating profit (₹ crores) | 5 | -68 |

| Profit before tax (₹ crores) | 73 | -9 |

| Net profit (₹ crores) | 60 | -9 |

| EPS (₹) | 1.34 | -0.20 |

Source: Screener

Annual performance

Here are some of the key financial metrics of the annual results as compared to the previous year:

| FY24 | FY23 | |

| Net revenue (₹ crores) | 3,438 | 2,558 |

| Operating profit (₹ crores) | -188 | -661 |

| Profit before tax (₹ crores) | 77 | -488 |

| Net profit (₹ crores) | 64 | -488 |

| EPS (₹) | 1.48 | -10.82 |

Source: Screener

Stock market reaction

The financial performance of PB Fintech for the Q4 of FY24 elicited a varied reaction in the stock market. The company reported a consolidated net profit of ₹60.19 crore, marking a significant turnaround from the loss of ₹9.34 crore in the corresponding period last year.

Despite this, the share price saw some fluctuations. On Wednesday, May 8, 2024, the PB Fintech shares initially opened on a positive note at ₹1,249.95, but soon dipped by 6.6%, touching an intraday low of ₹1,243.35.

This initial downturn was temporary as the PB Fintech share price made a comeback, hitting an intraday high of ₹1,279.55, a rise of 10.2% from the day’s lowest point. This recovery can be linked to the company’s robust financials, with revenue reaching ₹1,089.57 crore, a 25.36% increase year-on-year. The EBITDA also saw a notable improvement, moving from -5% to 4%.

The overall market sentiment was one of cautious optimism, mirrored in the slight uptick in the BSE Sensex. Market analysts from the brokerage firm Citi reacted favourably, issuing a ‘buy’ call on the stock and revising the target price upwards from ₹1,150 to ₹1,435.

This optimistic outlook is backed by the company’s impressive growth in the new health and life insurance sectors and its solid standing in the credit business.

Also read: How does intraday trading work?

Performance of different business segments

PB Fintech’s business model is primarily divided into two key segments:

Policybazaar

- Market dominance: Policybazaar dominates the online insurance aggregator industry in India, boasting an impressive 93% of the market.

- Customer base: The platform has successfully served 16.6 million customers who have conducted transactions, showcasing its extensive user base and appeal.

- Policies sold: Policybazaar has successfully enabled the transaction of 42.1 million insurance policies, underscoring its efficiency as an insurance platform.

- Financial performance: In Q4 FY2024, Policybazaar received an insurance premium of ₹5,127 crore, showcasing robust financial performance. This was supported by its product offerings, which included protection coverage (health & term) with premiums valued at ₹20 Crore in the Annualised Quarterly Run-rate (AQR).

- Partnerships: Policybazaar has established partnerships with 53 insurance providers, demonstrating its broad connections within the insurance sector.

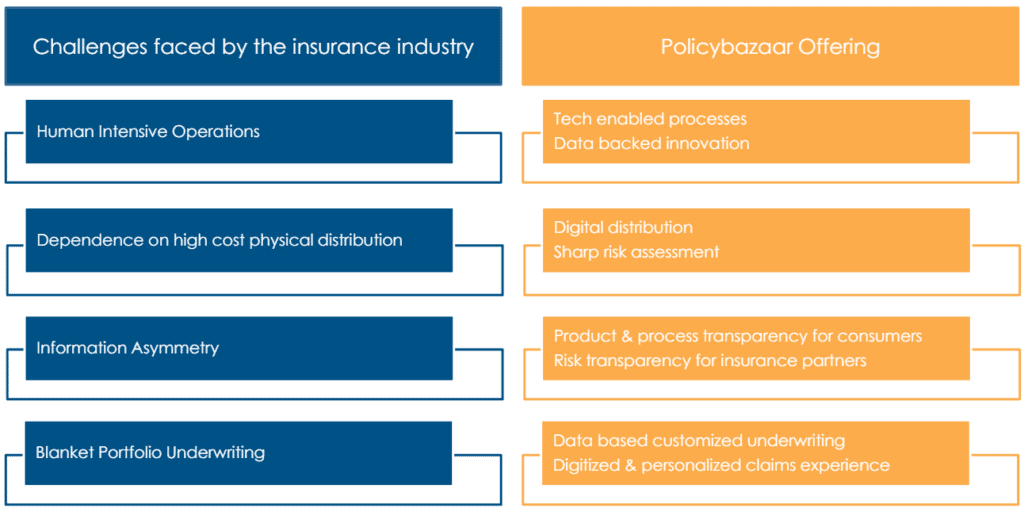

Here are some of the challenges faced by customers and the industry as a whole, that Policybazaar addresses:

Source: PB Fintech

Paisabazaar

- Market presence: Paisabazaar manages 20 lakh monthly queries related to credit products, establishing itself as a major entity in the Indian financial sector.

- Credit score awareness: The platform is acknowledged as the biggest initiative in India for credit score awareness, underscoring its dedication to promoting financial literacy.

- Loan disbursals: Paisabazaar has overseen loan distributions amounting to more than ₹14,800 crore, demonstrating its significant influence in the lending industry.

- Transactions: The platform has handled 19 lakh transactions in terms of Average Processing Rate (APR).

- Customer base: Paisabazaar prides itself on having a customer base of 4.3 crore score customers, showcasing its extensive reach.

- Credit cards issued: The platform has distributed around 6 lakh credit cards, thereby broadening its range of product offerings.

- Geographical reach: Paisabazaar operates in more than 1,000 cities throughout India, demonstrating its wide-ranging geographical coverage.

- New customers: In the fourth quarter of the fiscal year 2024, Paisabazaar welcomed an additional 21.2 lakh customers, indicating its ongoing expansion.

- Customer acquisition: The company emphasises that it gains a new customer every 4 seconds, showcasing its swift rate of customer acquisition.

Also read: Credit history: What is it and why it matters?

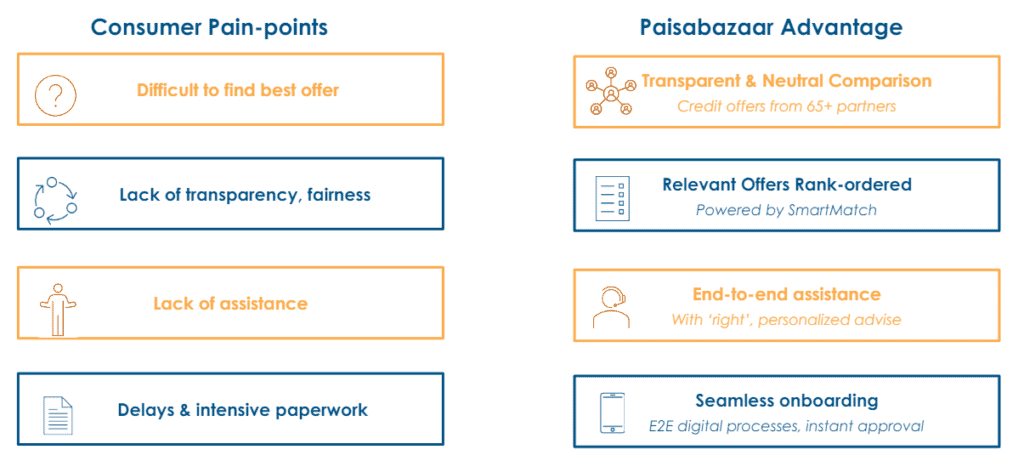

Here are some of the challenges faced by customers and the industry as a whole, that Paisabazaar addresses:

Source: PB Fintech

Bottomline

PB Fintech stands out as a leading player in India’s fintech landscape, epitomising innovation, efficiency, and market dominance across its flagship platforms, Policybazaar and Paisabazaar.

Policybazaar, with its significant market share and large customer base, is a leading force in the online insurance industry. Similarly, Paisabazaar has become a major player in the credit products sector, handling millions of queries monthly and facilitating large loan disbursements.

Market analysts’ optimistic outlook on PB Fintech, underscored by favourable target price revisions and recognition of the company’s solid performance across its business segments, reflects confidence in its growth trajectory and potential for value creation.