Fun fact: Did you know in the 1970s, the marginal tax rate on the highest income tax slab was 97.75 %? Shocking, right?

After paying this whopping figure, all you’re left with is 2.25 per cent, i.e., next to nothing. So, let’s put things into perspective.

Right now, the maximum marginal tax rate is 30 per cent. Now imagine you earn Rs.10 lakhs per annum, and you come under the tax slab having a marginal rate of 97.75 per cent.

After deducting all the taxes, you would save a mere Rs. 22,500. This figure may not feel too “mere” for you. But compare it to the actual earnings, and this tax rate seems astoundingly high.

India’s income tax regime has witnessed several changes post-independence. Here’s how this gigantic figure reduced to 30 per cent in 75 years.

Read Also: How Deadpool actor Ryan Reynolds got $75 million richer

97.75% taxation and mutual funds

India gained independence on August 15, 1947. Surprisingly, however, the 97.75 per cent tax regime existed for almost two decades, with some minor relaxations. Curiously, who or why this rate was imposed has yet to be known.

The only thing known was the intent – to reduce the fiscal deficit, i.e., the difference between government revenue and expenditure.

The question is – how did individuals sustain their income under such high taxation? Two words – “mutual funds”.

In 1963, mutual funds entered the Indian market. So, people took it as a source of additional income. But aren’t mutual funds taxable? Then how did Indians use it to protect themselves from the 97.75 per cent figure?

Capital gains on mutual funds were exempt from tax. And the tax on mutual fund dividends had to be paid by the fund house or asset management company (AMC). So, with zero taxes levied on investors, mutual funds became a safety net.

Tax history in India: reductions in 1974-75

After almost two decades of high taxation, relief finally came during the budget announcement of 1974-75. At that point, Y.B. Chavan was the finance minister of India. And he proposed to reduce the maximum marginal tax rate from 97.75 per cent to 75 per cent.

Subsequently, taxes were lowered at all levels of personal income. And those earning up to Rs.6,000 (equivalent to Rs.1.6 lakh today) were entirely exempted from income tax.

“The Committee has, accordingly, recommended that the maximum marginal rate of income-tax, including surcharge, should be brought down from its present level of 97.75 per cent to 75 per cent. Simultaneously, tax rates should be reduced at the middle and lower levels. This recommendation of the Committee has been accepted by Government with minor modifications. I, accordingly, propose to lower taxes at all levels of personal incomes.”

Yashwantrao Chavan

Former Indian Finance Minister

Here’s another exciting bit – What do you think was the primary motivation behind reducing the tax rate? It was not done to provide relief to people but to reduce instances of tax evasion.

The Committee, at that point, felt the main reason behind evading taxes was the high rate.

Justifiably so, evading was risky but profitable. Imagine saving just 2.25 per cent of your hard-earned money. This was motivation enough to find some shady method and evade taxes. The honest citizen, however, stood to gain peanuts.

Thus, the changes of 1974-75 became a landmark moment in India’s income tax journey with changes like –

- For the slab of Rs.70,000 and above (equivalent to today’s approx. Rs.19 lakh), the marginal income tax rate was lowered to 70 per cent.

Today, those earning Rs.19 lakh are expected to pay tax at a 30 per cent rate, with some deductions allowed

- The surcharge was made uniform across all levels of higher-income earners, at 10 per cent.

Today, this surcharge is levied on those earning 50 lakhs and above. Again, slabs have been created, and the surcharge differs based on the slab. It ranges between 10-37 per cent.

From a peak of 97.75% to 30% – The evolution of marginal tax rate

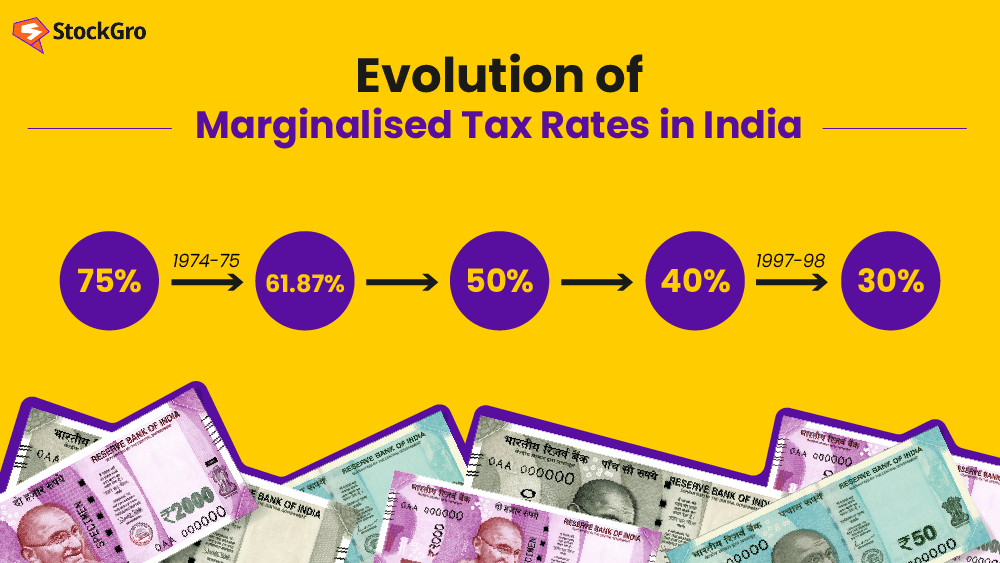

Post 1974-75, the income tax regime took almost two decades to look the way it does today. In these 20 years, the marginal tax rate decreased considerably –

Simultaneously, the tax rates on lower-income groups also changed. The 1997-98 “dream budget” reduced the highest marginal tax rate from 40 per cent to 30 per cent. Moreover, rather than 15, 30 and 40 rates, finance minister P. Chidambaram changed the tax rates to 10, 20 and 30, respectively.

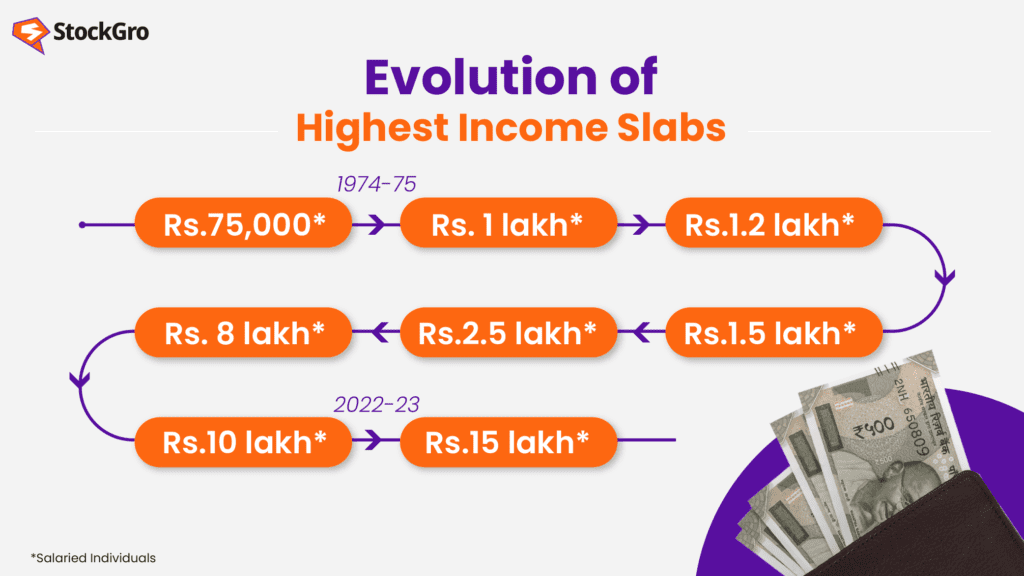

Even the highest income tax slab in India also changed gradually –

Additionally, several income tax deductions came into play. For example, Section 80D of the Income Tax Act allows you to claim a tax deduction if you have applied for a health insurance policy.

New deductions were added to the list with each policy and investment scheme. At one point, there were approx. 100 deductions on the list. This meant people had to go through these deductions while filing their income tax return to know where they fit.

Or you could ask your Chartered Accountant (CA) to do the heavy lifting.

However, not everybody can afford a C.A. So, during the 2020-21 financial year, the current finance minister Nirmala Sitharaman announced a new tax regime.

Almost 70 out of 100+ deductions/exemptions were done away with. And more slabs were reduced to compensate for these deductions. And those who were fond of the old regime could still opt for it.

In a nutshell, the Indian income tax regime has witnessed decades’ worth of changes to become the system that it is today. And in the future, you can expect more such changes in the system.

Or none at all, only the future knows.