The Indian startup scene has been going through a rough patch recently. They’re struggling to raise funds, shutting down parts of their businesses, and even laying off employees.

Nevertheless, the pain doesn’t end there. Additionally, investors have taken a second look at their valuations, resulting in a significant impact on India’s top startups. Valuations of several big names have been slashed by their own investors this year.

Let’s take a closer look at this trend and some of the most prominent startups affected by valuation markdowns.

The valuation craze and its consequences

Cast your mind back to 2016, a year that saw markdowns wreak havoc on Indian startups like Ola, Snapdeal, and Flipkart.

Similar to the scenario in 2016, we are currently observing another wave of valuation markdowns. Furthermore, it is crucial to note that global investors are now assigning lower valuations to Indian startups compared to previous assessments.

In 2021, Indian startups were riding high on the wave of capital pouring in. A staggering $42 billion was poured into these startups, causing their valuations to skyrocket. It was like a carnival of cash, with investors eager to get a piece of the action.

As a result, valuations of most consumer-facing platforms skyrocketed, fueled by the pandemic-induced boom. But here’s the catch!

Many of these startups lacked profitability despite their lofty valuations. The pandemic-induced boom further inflated their valuations, creating a bubble waiting to burst.

It was a gold rush, with valuations soaring while foundational metrics like profits were left in the dust. As the calendar flipped to 2022, the Indian startup ecosystem received a rude awakening. Geopolitical tensions and macroeconomic pressures brought a wake-up call for the Indian startup ecosystem.

Funding options became scarce, and profitability took center stage. This led to a trend of valuation markdowns in the latter half of 2022.

You may also like: Startup success: Swiggy turns profitable almost 9 years after inception

What exactly is valuation markdown?

Valuation markdown refers to a situation where the current potential selling price of a company is lower than its valuation in the most recent round of fundraising. In simple terms, investors believe that the company’s value has decreased since the last funding round.

India’s biggest startups and their valuation woes

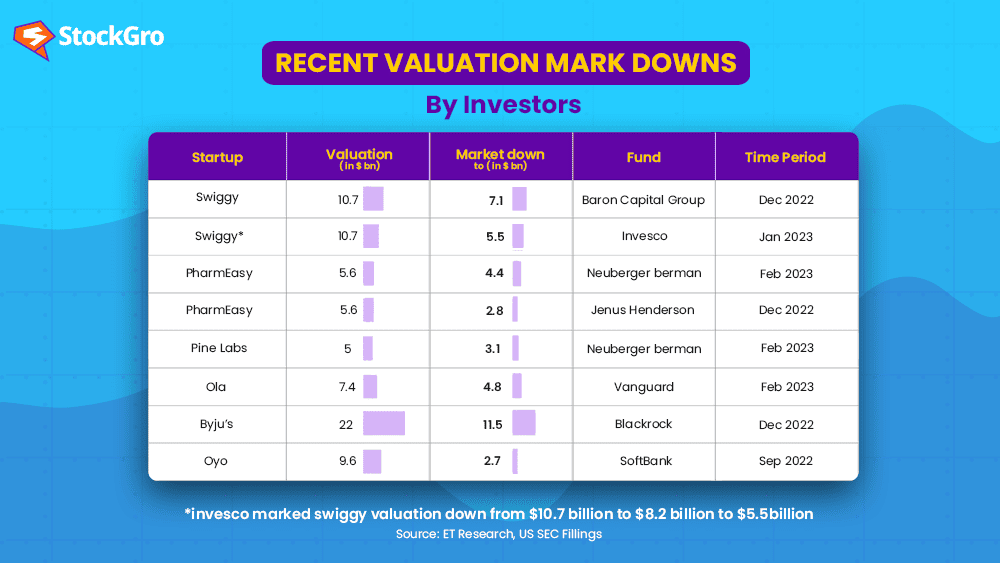

Let’s crunch some numbers of some top India startups that have recently experienced valuation markdowns:

OYO: The first casualty

OYO, the hospitality major, became one of the first casualties of valuation markdowns. In September 2022, global tech investor SoftBank slashed OYO’s valuation in its books by a significant 20% from $3.4 billion to $2.7 billion. This markdown served as a wake-up call for the industry.

BYJU’S: From highs to lows

BYJU’S, India’s most valued startup, faced a substantial blow when Prosus internally marked down its valuation by a staggering 73% in November 2022.

April 2023 brought another blow to BYJU’S. BlackRock, one of its minority investors, reduced the startup’s valuation by nearly half to $11.5 billion, down from the lofty $22 billion it once commanded. The markdown underscored the volatility of the market.

Swiggy: Downgraded twice

In January 2023, Invesco downgraded the valuation of Swiggy to $8 billion, just a year after leading a massive $10.7 billion funding round for the food-tech giant.

But the markdown didn’t stop there. In May 2023, Invesco revisited its strategy and further slashed Swiggy’s valuation to $5.5 billion, leaving the company grappling with its worth. It was like going from a lavish feast to a budget meal deal.

This markdown comes at a time when Swiggy is restructuring its workforce and shutting down unprofitable products.

Ola: A bumpy ride

US-based investment firm Vanguard Group decided to cut the valuation of ride-hailing startup Ola by 35%, from $7.4 billion to $4.8 billion, adding more turbulence to its already bumpy journey.

Recently, Neuberger Berman also trimmed the valuations of Pine Labs and PharmEasy by 38% and 21%, respectively.

Also Read: Wipro buyback 2023: All you need to know about repurchasing shares

Counting repeated mistake

Upon closer examination, a pattern emerges. Swiggy, BYJU’S, and PharmEasy all reached their valuation peaks during the Covid outbreak when they capitalised on the pandemic boom.

However, as normalcy returned, investor focus shifted to profitability and reducing cash burn. Unfortunately, the numbers didn’t align with their expectations.

Unfortunately, losses continued to pile up for these players, like a never-ending game of financial whack-a-mole.

For instance:

- BYJU’S recorded a staggering loss of INR 4,588 Cr in FY21, up 19.8X YoY. Ouch!

- Swiggy faced a net loss of INR 3,628.9 Cr in FY22, up 2X YoY. That’s a lot of zeroes!

- PharmEasy didn’t lag behind with a record loss of INR 4,043 Cr in FY22, up from INR 1,552 Cr in FY21.

The reasons behind valuation markdowns

Several factors have contributed to these valuation markdowns:

Macroeconomic factors: Due to the prevailing global economic conditions, characterized by negative trends, markets have become jittery, and there is a funding freeze in the startup ecosystem. This scenario impacts Indian startups as well.

Benchmarking and realignment: Investors are scrutinizing Indian startups in comparison to their local and international counterparts listed on the stock market. Consequently, if the valuations fail to align, adjustments are swiftly implemented.

Lack of profitability: Investors are becoming more focused on profitability and sustainable growth. Many startups, despite their high valuations, continue to face losses, which erode investor confidence.

One of the reasons behind these markdowns is the weakness in public markets and reduced investor appetite. As a result, some startups, like Pharmeasy, Oyo, and Boat, even decided to postpone their IPOs. It’s like delaying a big party because the guests aren’t in the mood.

A stream of IPOs and shifting trends

The stage was set for a grand show of IPOs. Zomato, Nykaa, Policybazaar, and other consumer internet startups took the spotlight, while digital technology saw widespread adoption across businesses due to the Covid-19 pandemic.

Venture capitalists and private equity firms joined the party, pouring money into Indian startups at an unprecedented pace and valuations in 2021.

But just as the curtains began to fall, a twist in the tale emerged. However, the Federal Reserve raised interest rates, and the influence of the pandemic started to fade. Consequently, the once-promising growth of startups and consumer internet unicorns hit a stumbling block.

Also Read: Answered: Why has the RBI withdrawn Rs. 2000 notes?

When things go wrong for startups

Now, here’s the double whammy. A prolonged funding winter, coupled with a crash in growth and late-stage deals, poses a significant challenge for unicorns. Investors and analysts warn that many startups may lose their billion-dollar status, like stars fading away in the night sky.

According to Venture Intelligence, around seven Indian startups have already lost their unicorn status in the last five years. The numbers speak for themselves:

- 105 startups became unicorns from calendar year (CY)18 to CY22.

- 84 active unicorns remain today due to various reasons.

- 7 startups experienced valuation markdowns and lost their unicorn status.

- 4 startups were acquired.

- Approximately 10 startups were listed in the last five years, stepping away from the unicorn tracker list.

It’s like a survival game where only the strongest will endure. The journey to unicorn status is a challenging one, filled with ups and downs, unexpected twists, and shifting tides.

Regulatory troubles

Swiggy, BYJU’S, and PharmEasy—these household names have been battling more than just financial challenges. They’ve also faced the tightening grip of regulations.

Swiggy is at the center of an antitrust probe. BYJU’S faced raids over FEMA violations. PharmEasy, the digital pharmacy segment player, is facing the threat of a ban.

What is the reason behind valuation markdowns?

There’s a common belief that burning capital is necessary to sustain growth, even before achieving profitability. Unfortunately, this wisdom has only fueled the problem of soaring valuations.

As startups relentlessly pursue scale, develop groundbreaking products, and experience rapid expansion, massive cash outflows become inevitable. Consequently, the aspiration of attaining unit-positive economics often takes a backseat.

Moreover, the excessive funding frenzy, driven by the objective of securing rapid capital infusion, blurs the boundaries between sustainable growth and inflated valuations.

The TAM mirage

Valuations have also suffered due to a mismatch between reality and revenue projections. Additionally, sometimes startups paint a larger picture of the total addressable market (TAM) than what can realistically be achieved.

Aligning revenue projections with ground-level possibilities is crucial for a more accurate valuation.

Impact of markdowns

Now, let’s delve into the implications of these markdowns. Will they have an impact on other startups? Well, not necessarily. It ultimately comes down to maintaining a realistic approach to valuations.

Startups must take a moment to reflect on past events from two years ago. By doing so, they can align their valuations accordingly. Additionally, if they remain grounded and pragmatic, there is still a chance of securing funding.

Notably, edtech unicorn upGrad and electric mobility startup BluSmart recently secured funds through a rights issue while maintaining the same valuation as their previous round, thanks to support from existing investors.

Now, the question arises: will Indian unicorns adhere to their valuations or willingly accept corrections? It’s akin to a tug-of-war between optimism and reality. Only time will reveal how this battle unfolds.