It was a regular day in 1923 when Oliver Gingold, an employee of Dow Jones, noticed that multiple stocks were trading at $200 or more. He termed them “Blue Chip Stocks” based on the game of poker and wrote an article about it. Since then, stocks of large corporations have come under the blue-chip stocks.

If you are an investor interested in equity investments offering low risks, blue chip may be a good option for you.

Read further to understand how a stock qualifies as a blue chip and what factors to consider before investing in these stocks.

You may also like: Discover the falling wedge pattern – your key to smarter trading

What are blue chip stocks?

Blue chip stocks are equity stocks of giant, well-performing corporations with financial stability and consistent financial performance. Blue chip stocks include large-cap enterprises or businesses with large market capitalization.

Market capitalisation is the total market value of all outstanding shares. A market capitalisation of ₹20,000 crore or more is necessary for companies to fall under this category. Such companies are called blue chip companies.

Also read: Find the key to trade when the hanging man appears on your candlestick chart

Characteristics of Blue Chip Stocks

- The primary feature of a blue chip company is its goodwill and creditworthiness. Blue chip companies are the ones that have been in the business for a long time, and they are seen as market leaders in the industry. This makes blue chip shares creditworthy.

- Since these companies are financially strong and stable, the returns on these investments are assured. The risk of payment default is rare.

- Share prices of blue chip companies do not fluctuate much. Hence, these stocks are less volatile to market conditions.

- Since price fluctuations are low, trading these stocks in the short term may not be very profitable. These investments are for the long-term to generate stable income.

- Blue chip stocks are highly liquid. They can be traded easily in the secondary market, considering the goodwill and reputation of blue chip companies.

Also read: What is spinning top candle and what does it indicate?

The rationale behind blue chip investments

There are various reasons for investors to invest in blue chip stocks:

- Blue chip stocks offer higher returns than regular stocks. Since these companies perform well, their profit margins are higher which in turn helps in giving higher dividends to its investors.

- These investments are secured as the companies have been in business for very long, withstanding all economic adversities.

- Investing in blue chip stocks helps in diversifying the portfolio as they mitigate the risk of loss from other investments.

- Blue chip stocks do not have extreme reactions to economic conditions like recession. Hence, blue chip companies’ share prices are less volatile making these investments safe.

- These stocks are easily tradable in the These stocks are easily tradable in the secondary market..

Risks and Disadvantages of Investing in Blue Chip Stocks

While blue chip stocks have low risks, they are not risk-free.

Some of the common risks or limitations are below:

- The investment in blue chip stocks is expensive. Since these are top companies with powerful performances and financial abilities, their share prices in the market are high.

- These companies have a slower growth rate as they have already reached their peak. Generally, they continue to grow at a diminishing rate.

- Since these companies have been in the industry for long, the management with experienced employees may be resistant to economic changes. Hence, they may not be able to adapt instantly to new technologies and changes in the industry.

Blue chip stocks in India

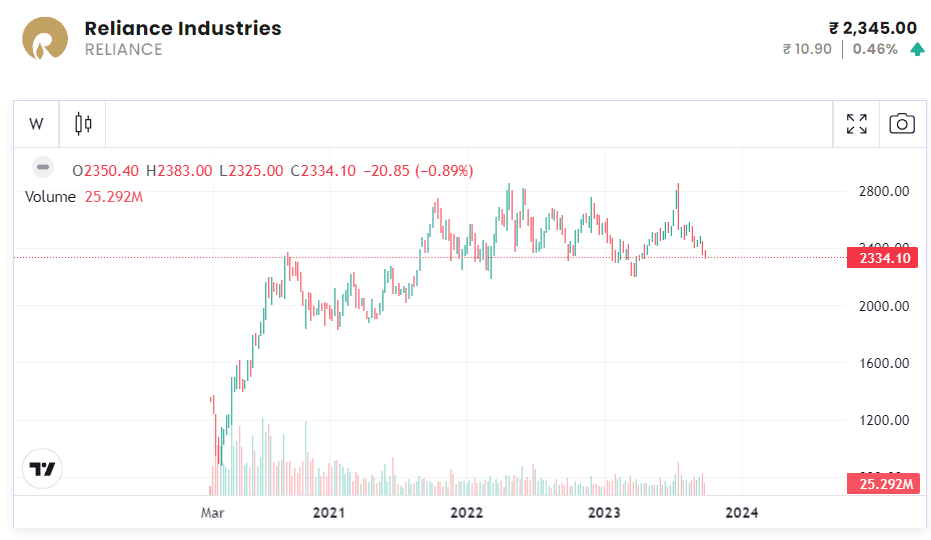

One of the top blue chip stocks listed on the NSE, Reliance Industries Ltd. is an Indian MNC headquartered in Mumbai, with a market capitalization of ₹16.5 trillion and a share price of ₹2,440 (As of 12 Sep 2023).

It is India’s largest public sector company. Founded in 1958 by Dhirubhai Ambani, Reliance has over 380,000 employees today. Reliance has its business spread across various lines like textiles, natural gas, telecommunication, mass media, retail, etc.

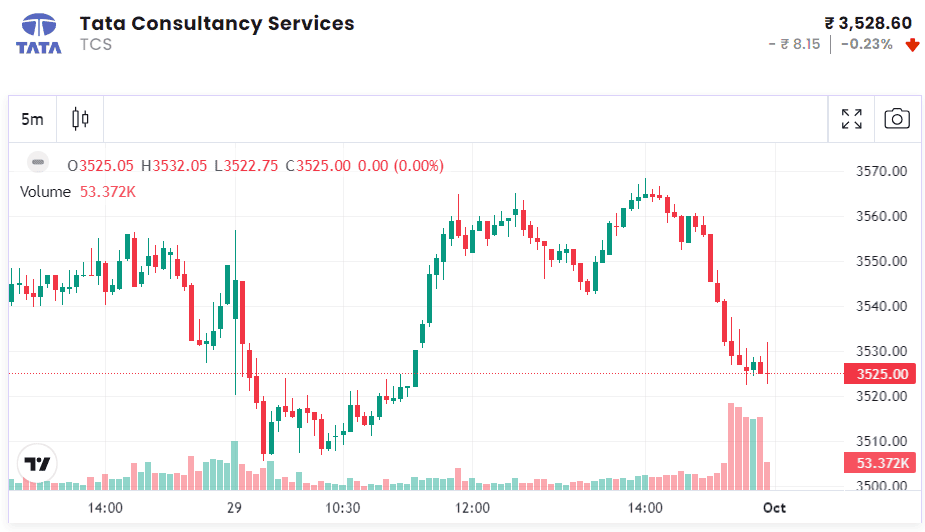

Founded in 1968 by J.R.D Tata and Faquir Chand Kohli, TCS is another blue chip stock listed on NSE. An Indian MNC with headquarters in Mumbai, TCS has over 600,000 employees.

Running its business in the IT and consulting sector, TCS has a market capitalisation of ₹13.1 trillion and a share price of ₹ 3,508.85 (As of 12 Sep 2023).

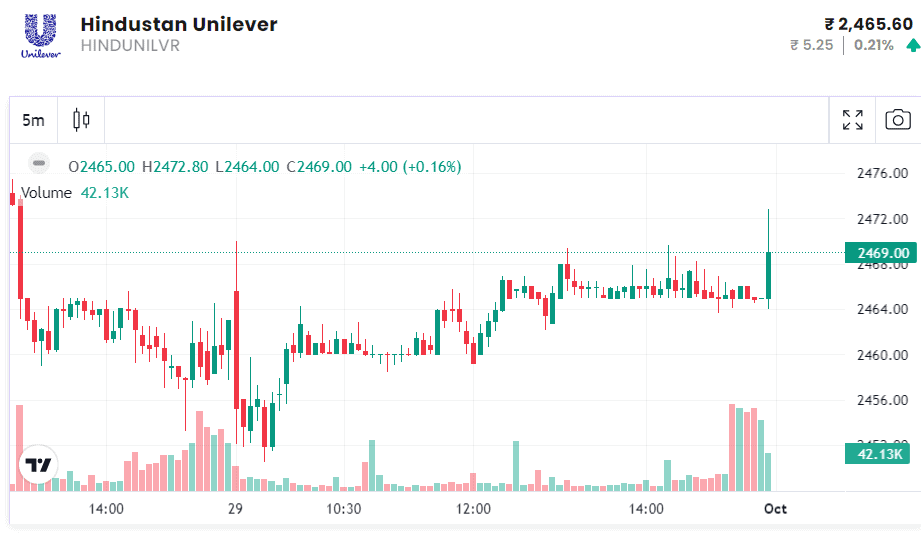

HUL was founded in 1933. It is an Indian company for consumer goods like food, beverages, personal care products, etc.

It has a market capitalisation of ₹5.86 trillion and a share price of ₹ 2,494.20 (As of 12 Sep 2023), HUL is another popular blue chip stock on the NSE.

Nestle India is a subsidiary of the Swiss MNC Nestle. Founded in 1959, Nestle has its headquarters in Gurgaon. It has its operations in food products, beverages and confectionery.

Nestle has a market capitalisation of ₹2.15 trillion and a share price of ₹22,303 (As of 12 Sep 2023).

Housing Development Finance Corporation Bank popularly known as HDFC Bank, is headquartered in Mumbai, India. With over 180,000 employees, HDFC is the largest private sector bank in India with respect to its assets. HDFC has a market capitalisation of ₹ 12.38 trillion INR and a share price of ₹ 1,634.15 (As of 12 Sep 2023).

How to Buy Blue Chip Stocks?

It is a very simple and straightforward process to invest in blue chip stocks in India. Let’s take a look at the steps you can follow to buy blue chip stocks:

Open a Demat and Trading Account

To begin with, in order to be able to invest in blue chip stocks, you need to have a Demat and trading account. You can open an account using various financial institutions such as banks, brokers, or online platforms. Your Demat account will store your shares electronically, while your trading account will allow you to buy and sell your stocks.

Research Blue Chip Companies

Once your accounts are set up, you should research companies that are considered blue chip stocks. These companies are typically part of indices like the Nifty 50, which includes well-established giants such as Reliance Industries Limited (RIL), Tata Consultancy Services (TCS), and Hindustan Unilever Limited (HUL).

You can find information on blue chip stocks from platforms like NSE’s official website or StockGro to find the companies you want to invest in.

Analyse Market Performance

It’s important to analyse the financial health and market performance of the companies you’re interested in before you go ahead and buy the blue chip stocks. You should consider factors like the price-to-earnings (P/E) ratio, dividends, return on equity (ROE), and historical performance of the companies.

Place an Order

After you’ve selected the stocks, you can log into your trading account to place an order. You can buy stocks at the current market price (market order) or set a specific price at which you want to buy them (limit order). Most platforms like Stockgro allow you to automate your investments through Systematic Investment Plans (SIPs), which can be beneficial for purchasing blue chip stocks regularly over time.

Track and Manage Your Investments

Once you have invested, you must actively track your portfolio. Blue chip stocks tend to be less volatile and they are suitable for long-term holdings. However, it’s essential to monitor company performance and stay informed about any economic changes that could impact your investments.

Bottomline

We now have clarity on the concept of blue chip stocks and their role in mitigating risks.

However, the blue chip stock prices being more expensive than regular shares, make it difficult for small investors to buy them in large quantities.

Though they have a component of risk, they are safer in comparison to other investments. Hence, an ideal portfolio should try to include some quantities of blue chip stocks, too.