Arranging the necessary capital to run the business is hectic but the most basic requirement for every company. While smaller companies rely on self-investments and loans, large public companies resort to public funds.

Raising funds from the public through shares is one of the most common ways of arranging capital.

So, how do public limited companies reward their shareholders for investing money in them? Yes, dividends are one of the ways. But, rewards over and above the expected income are always attractive. Aren’t they?

Issuing bonus shares is an effort in that direction. Let us explore bonus shares, their benefits and why companies issue them.

You may also like: Fractional shares: Unlocking stock market access for every investor

What is a bonus share?

Bonus share, as the name suggests, is a bonus issue of shares to investors. It is a corporate action where companies issue additional shares to existing shareholders free of cost.

- What is a bonus share ratio?

Bonus share ratio refers to the ratio at which a company issues additional shares to an investor. It determines the number of extra shares an investor gets for each share held.

For example, if a company announces the issue of bonus shares in the ratio of 5:1, it means that every investor will get five extra shares for one share held. So, an investor with 200 shares will get 1,000 shares more. The total shares come up to 1,200.

- What is the record date for bonus shares?

The record date is a significant component of corporate actions. The record date is the date when companies check the list of existing shareholders to determine the eligible shareholders who will participate in the corporate action.

For example, a company announces on 05th Nov 2023 to issue bonus shares. The record date is on 10th Nov 2023. So, shareholders who give up on their shares between 5th Nov-10th Nov will not be eligible for bonus issue.

Ex-date is another significant date for corporate actions. Regarding bonus shares, ex-date is the deadline date for investors to invest in the company to get the benefits of the bonus issue.

So, investors are eligible for bonus shares if they invest before the ex-date and continue to hold shares on the record date.

Why are bonus shares issued?

There are various reasons for companies to issue bonus shares. Issuing bonus shares acts like advertisements to attract more investors towards a company’s stock.

When bonus shares are issued, a company’s shares increase, making the stock more liquid. Also, the price per share comes down. Share prices come down in the same ratio of issuing bonus shares, making them more accessible to investors.

Liquidity and affordability are two significant factors that attract more stock investors.

Companies also do this to reward their existing shareholders for their contribution towards the business. By doing so, the company increases its image and goodwill. Bonus shares also serve as a message to the public about a company’s strong financial health.

Companies use their reserves to issue bonus shares without charging any additional cost from shareholders. So, the ones with a weak balance sheet need help to do this.

Despite the benefits, one limitation of issuing bonus shares is the opportunity cost. Companies choose to issue bonus shares and forego the option to invest the cash in reserves into more productive sources and earn more income.

- How to calculate bonus shares?

The company’s management decides the bonus ratio and impacts two aspects – the number of shares available and the price per share.

Here is an example to understand better:

Company ABC has a market capitalisation of ₹10 lakhs. It has 10,000 shares, and the current market price per share is ₹100.

The company announced a bonus issue in the ratio of 4:1.

So, every investor holding one share gets four additional shares.

After the bonus issue:

- Existing shares: 10,000

- Bonus shares: 10,000*4 = 40,000

- Total number of shares: 50,000

- Price per share: The price of one share is now divided among 5 shares. So, 100/5 = ₹20

- Market capitalisation: 50,000*20 = ₹10,00,000

So, the market capitalisation does not change after a bonus issue because the number of shares increases and the prices decrease to adjust themselves in the ratio of bonus issue.

Also Read: Wipro buyback 2023: All you need to know about repurchasing shares

Impact of bonus shares on investors

The primary benefit for shareholders is to receive shares free of cost. Though there is no increase in value immediately since the share prices reduce, it is beneficial in the long run when the share prices increase.

Receiving bonus shares is tax-free. So, there is another opportunity for shareholders to save costs. However, tax on capital gains is applicable if investors sell their bonus shares in the secondary market.

So, receiving bonus shares is quite a benefit to shareholders. However, one of the disadvantages is not receiving cash dividends. Companies choose to issue dividends in the form of bonus shares instead of cash. So, bonus shares can be a disappointment to investors expecting liquid cash.

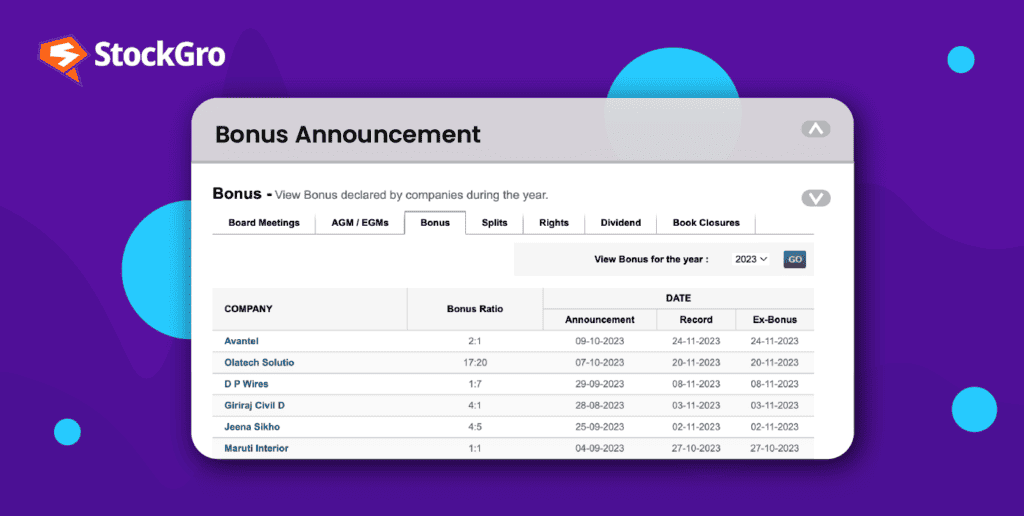

Example of bonus issue

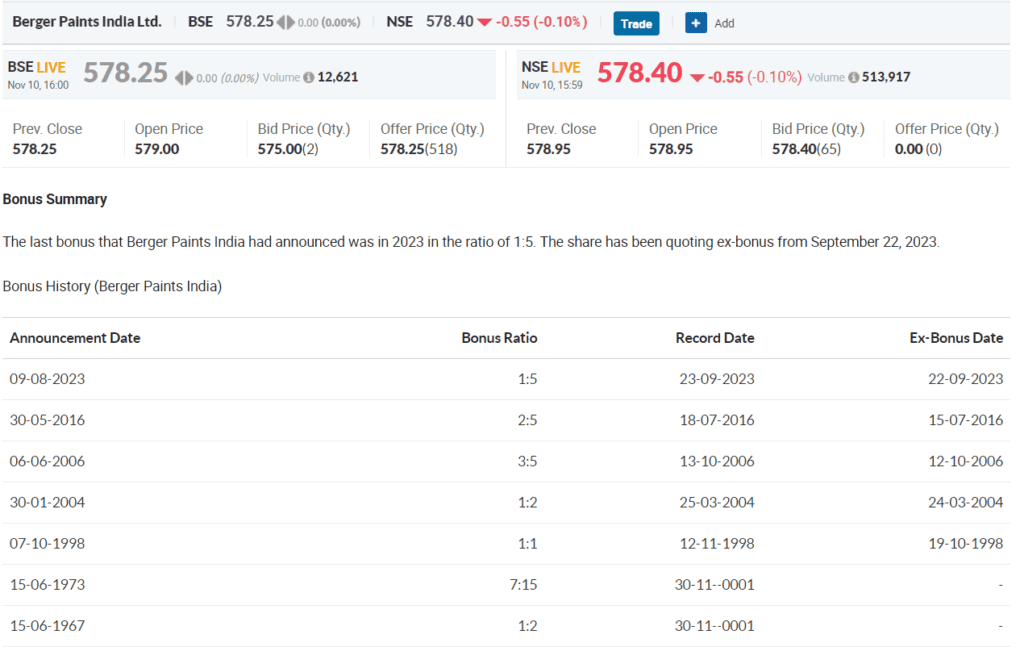

Berger Paints, a well-known Indian multinational paint company, announced the issuance of bonus shares in September 2023.

The details were as follows:

- Bonus ratio – 1:5 (5 extra shares for every share)

- Record date – 23 September 2023

Bonus share Vs. stock split

Stock splits may seem the same as bonus shares. They are similar, however, there are conceptual differences in these actions.

The objective of both these corporate actions is to reward existing shareholders and attract new ones by increasing liquidity and decreasing the price. But bonus shares refer to issuing new, additional shares, whereas stock splits involve splitting the existing shares.

Also, issuing bonus shares does not impact the face value of stocks, but stock splits affect the face value.

The additional shares an investor gets are also different. Consider an example to understand this.

Company ABC has 10,000 shares at ₹100 per share.

- Issuing bonus shares at 2:1

It means two additional shares are issued for one share, making the total to three shares. So, the number of shares of Company ABC goes up to 30,000.

- Stock splits in the ratio 2:1

It means one share is divided into two. So, every investor holding one share will have two shares now. So, the number of shares of Company ABC goes up to 20,000.

Also Read: ICICI Bank’s surprise move: Delisting ICICI Securities

Bottomline

Issuing bonus shares is a corporate action that companies undertake to reward existing shareholders and attract new investors. Since these shares are issued from the company’s reserves, it talks about the company’s efficiency and stable performance. It is also beneficial for investors since it increases the value of their investments in the long run.