The Indian pharmaceutical industry is expected to experience significant growth, reaching a size of $130 billion by 2030 with a compound annual growth rate (CAGR) of over 10%. Amidst this, Cipla and Sun Pharma have carved their niches, each with its unique strategies and growth trajectories.

In this vast ocean of pharmaceuticals, two names stand out – Cipla and Sun Pharma. These are not just companies; they are titans that have transformed healthcare in India and made significant strides on the global stage.

This article embarks on an exploration of Cipla vs Sun Pharma, delving into the stories of these two giants. It unravels their strategies, dissects their growth trajectories, and highlights the key differentiators that set them apart.

Also read: https://www.stockgro.club/blogs/trending/pharma-industry-in-india/

Company profiles

Cipla

Established in 1935 by Dr K.A. Hamied, Cipla has expanded its operations to become a renowned Indian multinational pharmaceutical company with a global reputation. Cipla, headquartered in Mumbai, has a global reach, operating in over 80 countries. They offer a wide range of products, with over 1,500 options in different therapeutic categories and more than 50 dosage forms.

Cipla’s mission, ‘Caring for Life’, is more than just a slogan – it truly drives its operations. The company has consistently prioritised providing affordable and high-quality medicines to support patients in need. Cipla has gained the trust of healthcare professionals and patients worldwide for the past eighty years.

In India, Cipla offers a range of consumer brands, including Nicotex, a nicotine replacement therapy; Cofsils, a line of cough and cold remedies; Cipladine, an antiseptic; ORS, an oral rehydration solution; and Omnigel, a pain relief gel. In South Africa, their product lineup features Cipla Actin, an antihistamine; Broncol, a bronchodilator; Flomist, a nasal spray for allergies; Asthavent, an asthma inhaler; and Coryx, a cold and flu medication.

The Cipla’s market share in India is 5.1%.

Cipla’s share price performance

In the past 5 years as of 12th April 2024, the Cipla share price history has shown an impressive return of 149.23%.

As of April 12, 2024, the Cipla share price is ₹1,399.55.

Sun Pharma

Founded in 1983 by Dilip Shanghvi, Sun Pharma has emerged as a dominant player in the global pharmaceutical industry. Sun Pharma, headquartered in Mumbai, India, is a leading global speciality generic pharmaceutical company.

Sun Pharma aims to make a global impact as a top provider of essential medications, improving the lives of people worldwide. This vision is realised through Sunology, a distinctive ideology that merges the essence of Sun Pharma with a set of guiding principles.

These principles encompass a strong sense of humility, unwavering integrity, boundless passion, relentless innovation, unwavering commitment to quality, unwavering reliability, building trust, maintaining consistency, and fostering a culture of innovation.

The company offers a wide range of products that cover various therapeutic segments, such as psychiatry, anti-infectives, neurology, cardiology, diabetology, gastroenterology, ophthalmology, nephrology, urology, dermatology, gynaecology, respiratory, oncology, dental, and nutrition.

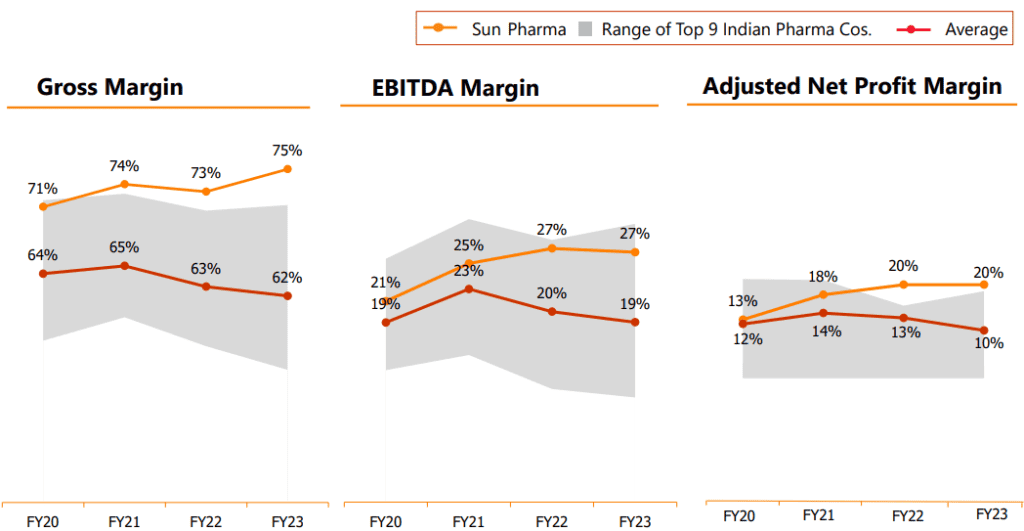

Sun Pharma’s impressive growth can be attributed to its unwavering dedication to research and development, as well as its constant pursuit of innovation. The company operates approximately 40 manufacturing facilities globally and has research and development centres located worldwide. Its workforce is incredibly diverse, with employees from more than 50 different nationalities.

The market share of sun pharma in India is 8.5%.

Sun Pharma share price performance

In the past 5 years as of 12th April 2024, the Sun Pharma share price history has shown an impressive return of 233.55%.

As of April 12, 2024, the Cipla share price is ₹1,545.00. Moreover, Sun Pharma’s ADV share is trading at ₹408.25.

Financial profiles

Here are Sun Pharma’s financial ratio analyses based on Sun Pharma’s financial statements, compared with Cipla’s financial results based on Cipla’s financial statements:

| Cipla (March 2023) | Sun Pharma (March 2023) | |

| EPS (Rs.) | 31.15 | 7.00 |

| PBIT Margin (%) | 23.13 | 24.75 |

| Net Profit Margin (%) | 15.91 | 8.12 |

| Return on Capital Employed (%) | 14.67 | 15.79 |

| Asset Turnover Ratio (%) | 0.60 | 0.51 |

| Current Ratio (X) | 4.95 | 1.97 |

| Inventory Turnover Ratio (X) | 1.08 | 1.40 |

| Retention Ratios (%) | 83.94 | -49.00 |

| Earnings Yield | 0.03 | 0.01 |

These ratios paint a picture of the financial year 2023.

Also read: https://www.stockgro.club/blogs/stock-market-101/what-is-eps/

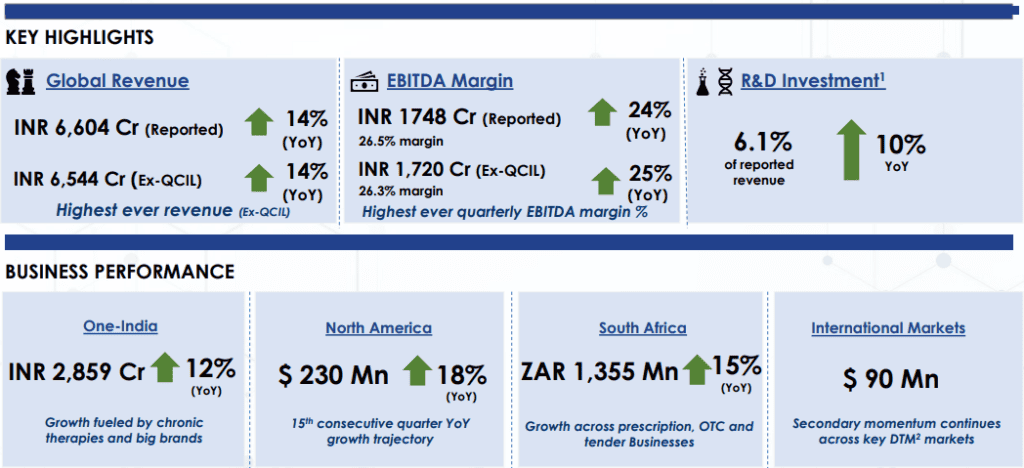

Moreover, in the fourth quarter of FY2024, Sun Pharma released the following results.

Reasons for growth

Cipla

- Market-leading growth: The company has seen strong growth in its key markets, such as India, North America, and South Africa, which has positively impacted its overall performance.

- Brand expansion: Cipla has been dedicated to expanding its portfolio of large brands, and has seen impressive revenue growth for several of its brands in different markets.

- Pipeline investment: The company has made strategic investments to enhance its future pipeline, through both internal growth and acquisitions, by introducing new products and prioritising development initiatives.

- Operational efficiency: Operating margins have shown improvement, thanks to factors such as a favourable product mix, carefully adjusted pricing strategies, and effective cost management.

Sun Pharma

- Product mix: The company saw an increase in growth thanks to an improved product mix, which included a boost in speciality sales.

- Speciality business: There was substantial expansion in the speciality business, especially in the U.S. market.

- Market share: Sun Pharma continues to dominate the pharmaceutical industry in India, solidifying its position as the top company with a growing market share.

- New launches: The company introduced a range of new products, which played a significant role in driving its growth.

Company strategies

Cipla

- Global expansion: Cipla is committed to expanding its global presence, with a strong emphasis on incorporating sustainability and responsibility into its strategic approach.

- Innovation and digital transformation: The company is dedicated to fostering innovation, utilising cutting-edge technology and AI to improve patient-centred care.

- Consumer health focus: Cipla is focused on collaborating with consumers to support their wellness journey and substantially expanding its consumer health business.

- Investment in future therapies: The company is expanding its investments into emerging sectors, including biosimilars, mRNA, and CAR(T)-cell therapies, with a focus on tackling chronic diseases.

Sun Pharma

- Specialty business expansion: The company is looking to expand its global speciality business, specifically in the areas of dermatology, ophthalmology, and onco-dermatology.

- Innovation and R&D: Sun Pharma is dedicated to innovation, with a strong focus on developing medicines to address the needs of patients and enhancing its research and development pipeline with new candidates.

- Operational efficiency: The company aims to enhance manufacturing efficiencies, streamline its manufacturing operations, and lower fixed costs.

- Strategic acquisitions: Sun Pharma plans to consider potential acquisitions to enhance its global speciality portfolio, taking advantage of its robust net cash position.

Also read: https://www.stockgro.club/blogs/personal-finance/what-is-ebitda/

Future outlook

Cipla Limited is poised for ongoing growth and expansion in its key markets, including One-India business, North America, and South Africa.

The company has emphasised its dedication to expanding its major brands and making strategic investments in its future pipeline, which includes addressing regulatory issues at its facilities.

With a strong lineup of products, including potential launches in Europe and ongoing evaluations for the U.S. market, Sun Pharma is well-positioned for continued growth.

The company’s management is dedicated to expanding its presence worldwide, improving its range of products, and ensuring a strong financial position, as demonstrated by its positive net cash position.

The prospects for Sun Pharma are quite positive, as the company has a well-defined plan to enhance growth by focusing on innovation, forming strategic alliances, and expanding into new markets.

Bottomline

India’s pharmaceutical industry is poised for significant growth, led by Cipla and Sun Pharma. Both have achieved success through unique strategies and a commitment to quality healthcare.

Cipla’s global presence and patient-centric approach ensure its sustainable growth, while Sun Pharma’s global dominance and focus on expansion and efficiency position it for continued leadership.

As these titans navigate evolving landscapes, they continue to drive innovation and transform healthcare for millions.